Insurance and inflation: Looking at the dollars and cents

March 8, 2022 — Homeowner insights | Inflation insights | Insurance insights

While most parts of the economy are experiencing inflation of around 7% to 8%, building labor and material costs are up nearly 20%, which is the highest in 40 years.

Inflation may feel more like a topic for economists than one for around the dinner table with friends. Maybe you hear analysts discussing it and see the headlines, but it doesn’t really resonate with you. Then you’re in line for gas, and the price keeps getting higher and higher, and it’s starting to feel real. Next, you head to the grocery store, and your crisp $20 doesn’t get you as much as it used to. Now the inflation conversation has your attention.

Inflation has impacts beyond your daily living expenses. While most parts of the economy are experiencing inflation of around 7% to 8%, building labor and material costs are up nearly 20%. This is the result of increases for materials like lumber, which is up 41% YOY from October 2021. Plywood is up 88% for that same period, and copper wire is up 156%.1 Additionally, 92% of contractors report difficulty finding skilled workers. The shortage of workers means higher wages. From October 2020 to October 2021, residential and commercial labor costs grew 7%.1

These dramatic increases stem from disruption to the production of goods, labor shortages and resourcing. If you’re not in the market to build a new home or start a renovation, you may think this won’t impact you, but each of these supply disruptions has a direct effect on homeowners.

During periods of inflation, part of making your dollar go farther includes protecting your assets. Your home is likely one of your greatest assets, and your homeowners insurance policy is how you protect it. With inflation in the building labor and materials sector heightened beyond the normal levels, your homeowners insurance coverage increases so you are protected in the event of a loss.

Here’s how inflation is impacting your insurance

Having a homeowners policy ensures that if disaster strikes – hurricanes, house fires, hail – your home and belongings will be restored. To make good on the promise to restore your home and the things you work so hard for, insurance companies calculate the cost to rebuild your home should one of these events occur and set your rate and premium based on those calculations. The cost to rebuild your home is outlined in your policy as your Coverage A replacement cost.

Reconstruction costs impact your Coverage A amount and are calculated using the following:

- Building materials: lumber, copper, aluminum, cement, etc.

- Skilled labor: roofing, electrical, plumbing, carpentry, HVAC, etc.

- Fuel/oil prices

- Size and square footage of the home

- Property fees and ordinances

Each one of these factors is seeing higher-than-normal inflation rates. The combined effect has driven reconstruction costs up, making inflation for building labor and material nearly 20%. The bottom line: Your house will cost more to rebuild today than it did before the building labor and material increases occurred. Without the necessary increases to your coverage, your home would be underinsured, leaving a gap in coverage.

Insurance and inflation over time

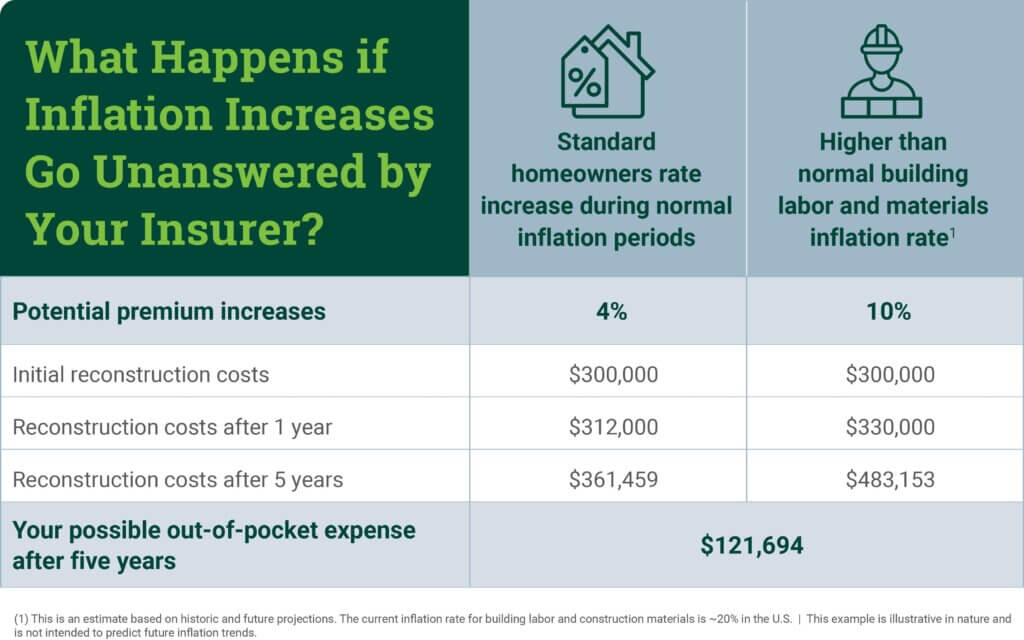

The table below shows the impact of inflation on a home and what it would cost to rebuild. By the fifth year, if the inflation rate for building labor and construction materials remains high (10% as the average), the home reconstruction cost would be undervalued by over 25% after including the standard homeowners annual inflation increase of 4%. This leaves a major gap in coverage if the property value of a policyholder’s home is not adjusted for on the insurance policy (the Coverage A limit).

View or download the graphic as a PDF.

A real-life example of inflation and insurance

No one wants to think about experiencing a loss, but imagine that in year five, based on the estimates above, a major weather event destroys your home and it must be rebuilt. The home builder you select provides an estimate of $483,153. If you or your insurance company has not properly adjusted your coverage limits, your insurer will pay you $361,459, leaving you $121,694 short – an amount you would have to pay out of pocket to rebuild your home.

Without premium increases, your home won’t be fully covered, and there is no peace of mind in that. Your insurer should be working to adjust your coverage limits for the current market environment. No one wants to see homeowners insurance increase, but without these necessary increases, the coverage you thought you had isn’t enough. Having an insurance company that understands the economic impacts of inflation beyond increases in living expenses and is working to make sure you’re covered means you can rest easy knowing you’re protected – no matter what the economic climate.

For more information about how inflation impacts your homeowners insurance premiums, visit sagesure.com/inflation.

The information provided in this article does not, and is not intended to, replace the advice and counsel of your insurance representative; instead, all information, content and materials available on this page are for general information purposes only. Data provided may not constitute the most up-to-date information.

1. https://www.corelogic.com/wp-content/uploads/sites/4/2021/12/Final-QCI-Q4-21.pdf