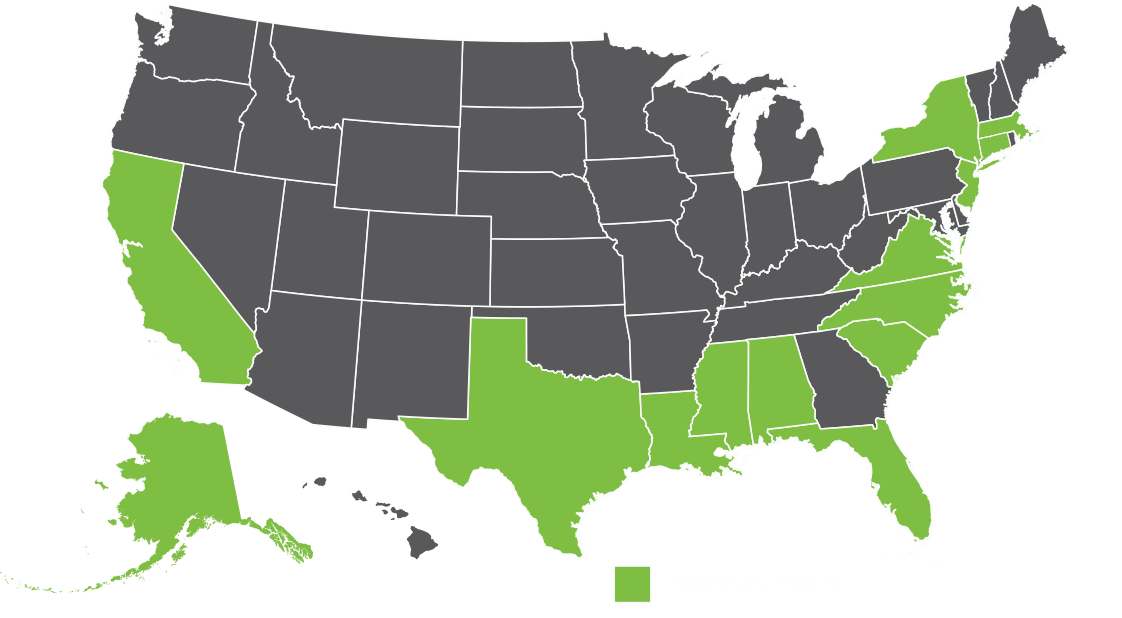

The gap in coverage due to inflation has compounded year-over-year in SageSure states

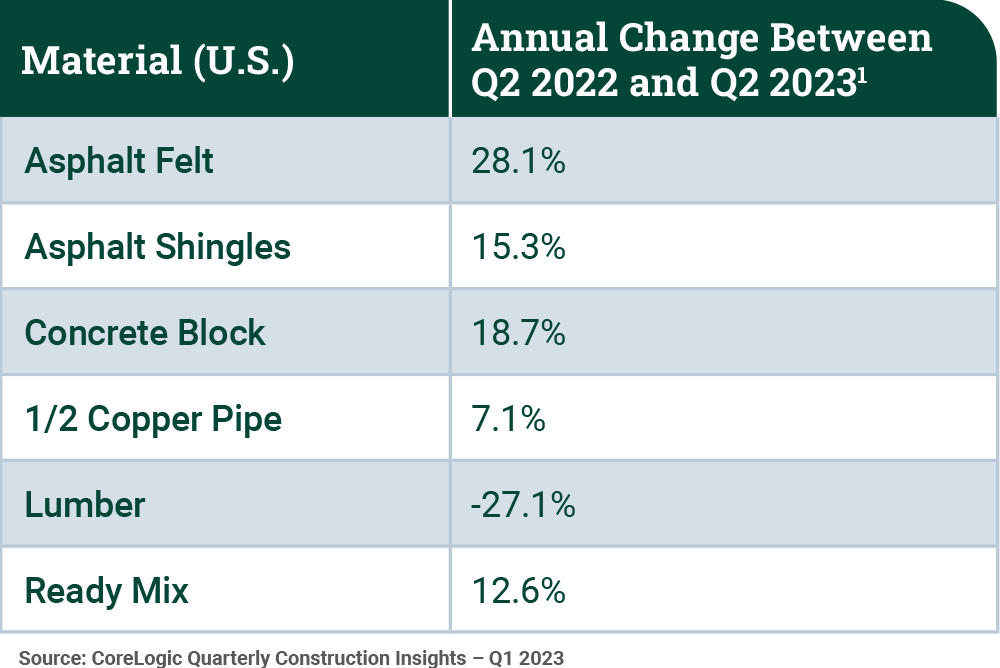

The inflation coverage gap across SageSure states is still as high as 8%, in addition to the increases experienced last year. To ensure your home is properly protected, your dwelling coverage needs to be updated to reflect the most recent increases in rebuilding costs.