Business Insurance in South Carolina

Business Insurance in South Carolina

What is BOP insurance?

BOP stands for businessowners policy and is simply commercial lines of insurance that can be packaged together to protect small businesses from property and liability risks.

Here are some of the SafePort and SURE BOP highlights:

- Comprehensive coverage at a competitive price

- Statewide capacity

- Broad appetite for risk

- Flexible payment options

- Discounts for SageSure personal lines customers

Who needs a BOP?

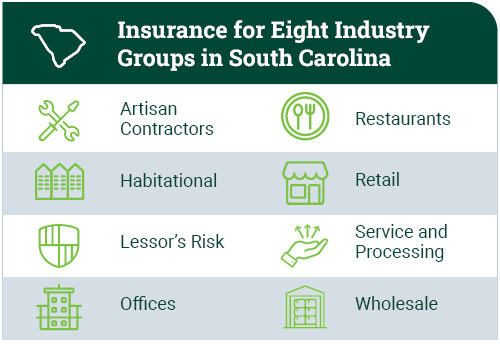

Any business interested in protecting their property, income and financial assets. And insurance for businessowners helps keep business running as usual with coverage against loss, theft, damage, injury, fire, and other included disasters. In South Carolina, we insure over 400 classes in eight industry groups.

Are you an insurance agent?

Enroll with us today for access to our highly rated BOP options to start protecting South Carolina small businesses.

For more information about our products, please contact:

Gregg Robitaille

Susan Miley

Are you a policyholder? Give us a call for more information about products and policies for small businesses in South Carolina. Reach our customer care team at (800) 481-0661.

Are you a business owner interested in BOP insurance through SageSure? Find an agent near you to get a quote.