SageSure celebrates two successful years in commercial insurance

Protecting small business owners’ dreams with commercial lines

November 3, 2022 — Business insights | Insurance insights

It’s been two years since SageSure extended our personal lines insurance expertise to the commercial insurance space with our first bound businessowners policy (BOP). We’re passionate about offering insurance products that provide peace of mind, so individuals, and now businesses, can focus on what’s most important without worrying about life’s “what ifs.” More than 75% of businesses experienced an event in 2020 that could result in an insurance claim.1 With insurance for small business owners, you don’t have to focus on things like property damage, theft, injury or cyberattack, which take valuable time and energy away from growing your business. With the right businessowners policy, if life’s worst moments happen, you can restore your dreams and livelihood.

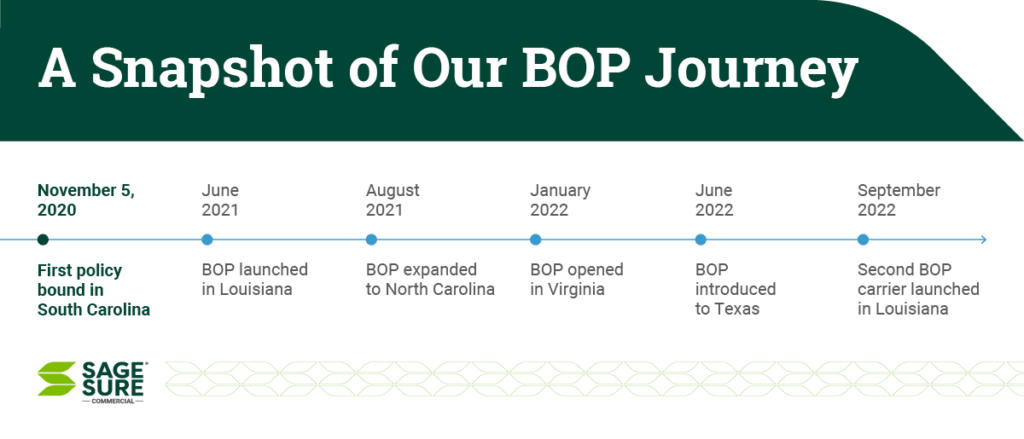

We’re celebrating the anniversary of writing our first BOP by reflecting on how we got started, showcasing our growth and looking to the future of commercial lines at SageSure.

Extending our expertise to commercial insurance

We go where others won’t. Providing property insurance in coastal markets is our specialty. Our producer partners expressed interest in offering a BOP product to their customers. We saw the opportunity to take that same proprietary underwriting approach and expert catastrophe risks pricing and apply it to a commercial lines product to provide a profitable and diversified portfolio of products for our partners and carriers.

A product in the making

Though our first bound BOP was in 2020, there were years of diligent work behind the scenes to create a dependable, competitive and comprehensive product for launch. In 2018, we hired Victor dos Santos as our president of commercial insurance and tasked him with building a team to bring our commercial business to life. By leveraging our existing technology, tweaking and customizing it to fit a BOP, we designed a beta version, sought producer feedback and improved the product.

We chose South Carolina as our launch state because we saw the market need and the opportunity was right. Our producers were telling us that they were ready for a competitive BOP option, and the regulatory environment was conducive to making it available quickly. “We had very eager producers [in South Carolina] willing to help us and bring us to the first version of the product,” Victor said. “We took it from there and rolled out other states, using the same formula and adjusting that formula along the way.”

SageSure Commercial Lines today

SageSure BOP is also available in Louisiana, North Carolina, Virginia and Texas. In September of this year, Louisiana became our first state to offer BOP from two carriers, SafePort Insurance Company and SureChoice Underwriters Reciprocal Exchange (SURE). We also broadened our product offering to include endorsements for cyber, EPLI and equipment breakdown coverage.

Gregg Robitaille recently joined our team as a commercial sales manager, strengthening our commitment to support producers who provide insurance to small business owners. Our team continues to expand, and we are always fine-tuning our products and processes to provide the best service possible.

What’s next for SageSure Commercial Lines?

We anticipate expanding BOP to four additional states in the coming year. Plans also include adding a second carrier option in existing states. By 2025, we anticipate offering commercial insurance to the same states where we have personal lines. We will also continue to create and refine other commercial products, as opportunities exist.

“As we look ahead to the future at SageSure Commercial, we’re very excited about the opportunity ahead of us,” Victor said. “We know we have the team, the producers, the partners, the carriers to get us there. Our insurance-first attitude and way of executing are what’s going to differentiate us.”

For more information about insurance for small business owners and product offerings, visit https://www.sagesure.com/agents/commercial-insurance/.

- https://advisorsmith.com/data/small-business-claims-statistics/