Quoting tips to get the best rate for your customers

Mitigate premium increases resulting from inflation

While inflation is showing signs of decline, it remains a factor in homeowners insurance. Even as inflation in building labor and materials decreases from record highs, it still costs 11% more to rebuild the average home today than it did before the pandemic.1 Inflation will remain a factor in 2023 with homeowners insurance costs rising.

As a trusted insurance expert, policyholders will look to you for answers about why their premium is increasing and how they can lower their costs. Ensuring that each property is insured to value is nonnegotiable, but there are some ways to lower premium and still provide the comprehensive coverage your insured is counting on.

Here are some tools to help you navigate the continued increases in policyholder premiums.

Provide inflation resources

Inflation isn’t something most homeowners interact with beyond their grocery and gas bills. And explaining how it affects homeowners insurance certainly isn’t easy. We’ve created several resources that you can share with policyholders to help them understand how rising prices are impacting the cost to rebuild their home should a loss occur.

These FAQs are simple, straightforward and easy to share. For a comprehensive look at inflation, direct your policyholders to sagesure.com/inflation.

Check for discounts

Make sure no opportunity for cost savings goes unchecked. Even if you reviewed discount opportunities with your insured when you bound the policy, life changes could mean discounts now apply. Have a conversation with your policyholders to assess possible discount options.

Enroll them in EasyPay

Enrolling your customer in EasyPay sets them up for automatic payments and essentially waives the installment fees. You can help the insured with this process, or they can set it up on their own from MySageSure.com.

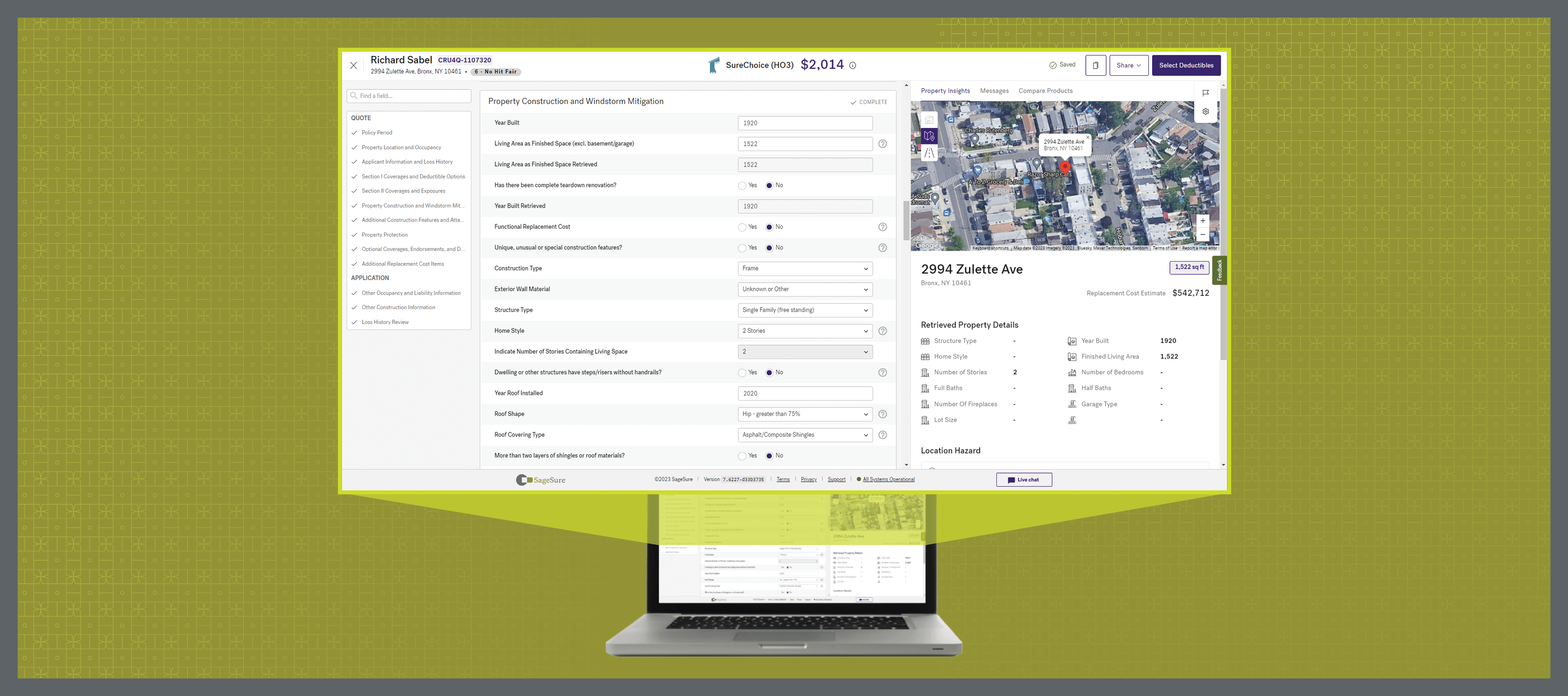

Confirm home age

For homes built prior to 1940, select the functional replacement cost (FRC) option. Run the replacement cost estimate. Then, run it again, removing the FRC option and compare the two premium estimates. You may be pleasantly surprised that choosing functional replacement cost to replace a damaged home, built prior to 1940, with modern day materials will likely provide a significant reduction in premium.

Evaluate deductibles

Have a conversation with your insured about deductibles. If they have more available cash savings they can dip into in case of a loss, they may be willing to increase their deductible to lower their premium. This option isn’t for everyone. Remind insureds how deductibles work and what their out-of-pocket expense would be at the time of a loss. Help them navigate scenarios that allow them to confidently arrive at whether this is the best option.

Be proactive during quoting

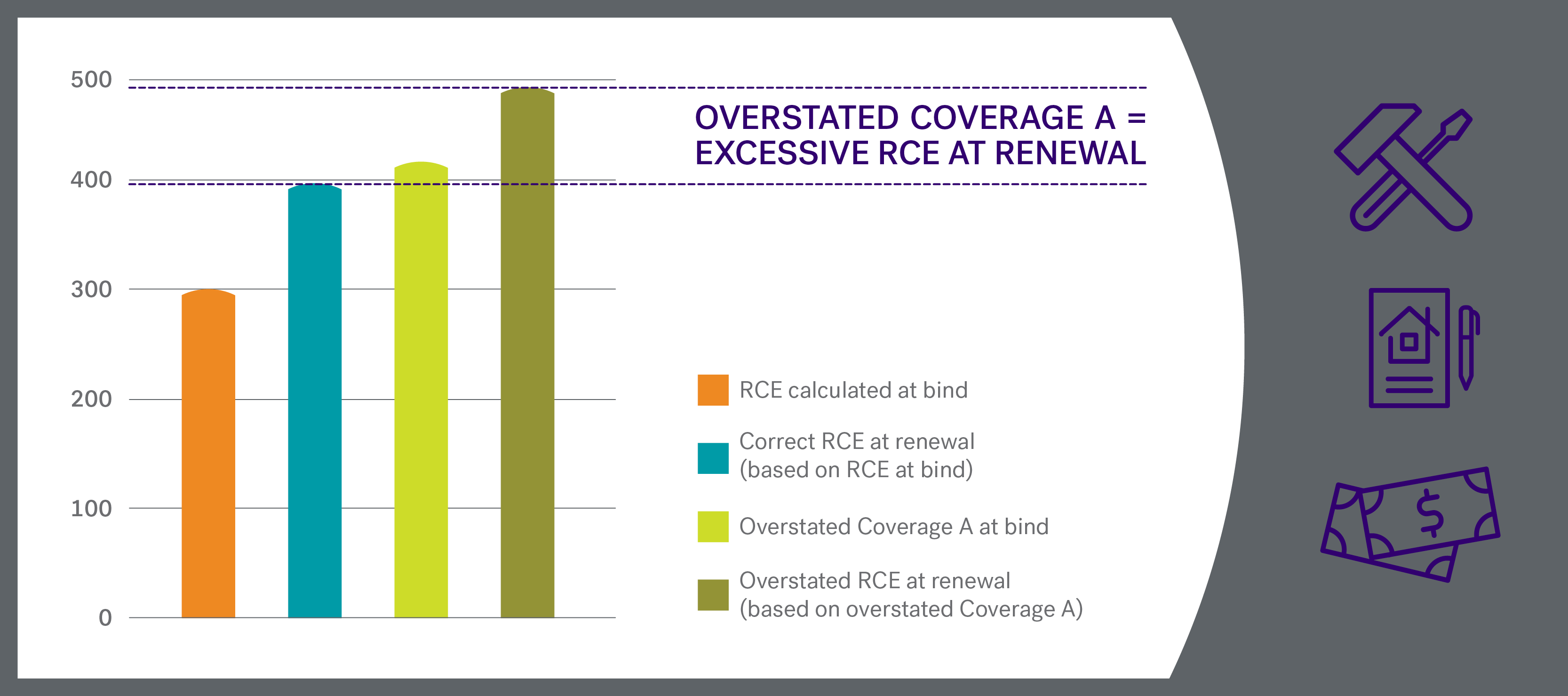

Use dwelling additional amounts of insurance instead of padding Coverage A at bind. Padding Coverage A can be a way to ensure homeowners are fully covered in the case of a loss, but remember, reconstruction cost estimate (RCE) at renewal is based on the prior year’s Coverage A.

Overstating Coverage A at bind can lead to higher-than-expected cost increases in the premium during the renewal process. If you have a policy where Coverage A was intentionally inflated at bind, contact your account manager for assistance.

These tips, and other inflation information can be reviewed in the on-demand inflation webinar accessible on the Agent Portal Resources page. Webinars are listed on the right side of the console in the Learning Spot.