What Is an MGU?

March 22, 2022 — Homeowner insights | Insurance insights

Modern-day insurance has simple origins. As far back as 3,000 years, sea merchants would divide their goods among ships as the vessels crossed dangerous waters to reduce risk. What started with uncomplicated origins has become far more intricate.

Today, insurance involves many more players to protect against risk. While you might only interact with your insurance representative or agent, a lot more is happening behind the scenes to make it possible to protect your most valued assets.

Entities like managing general underwriters (MGUs) or managing general agents (MGAs) are specialized insurance intermediaries that can sell, administer, service, and underwrite policies and handle claims on behalf of an insurance carrier.

MGA vs MGU: What Is an MGA?

The term managing general agent (MGA) is now interchangeable with MGU. While MGAs were historically more involved with claims than MGUs, today both perform many services that were typically carried out by insurers. Both can:

- Appoint retail agents.

- Underwrite, bind, and issue insurance policies.

- Collect premiums.

- Manage claims.

- Provide efficiency throughout the insurance value chain.

- Leverage risk exposure data to improve underwriting results.

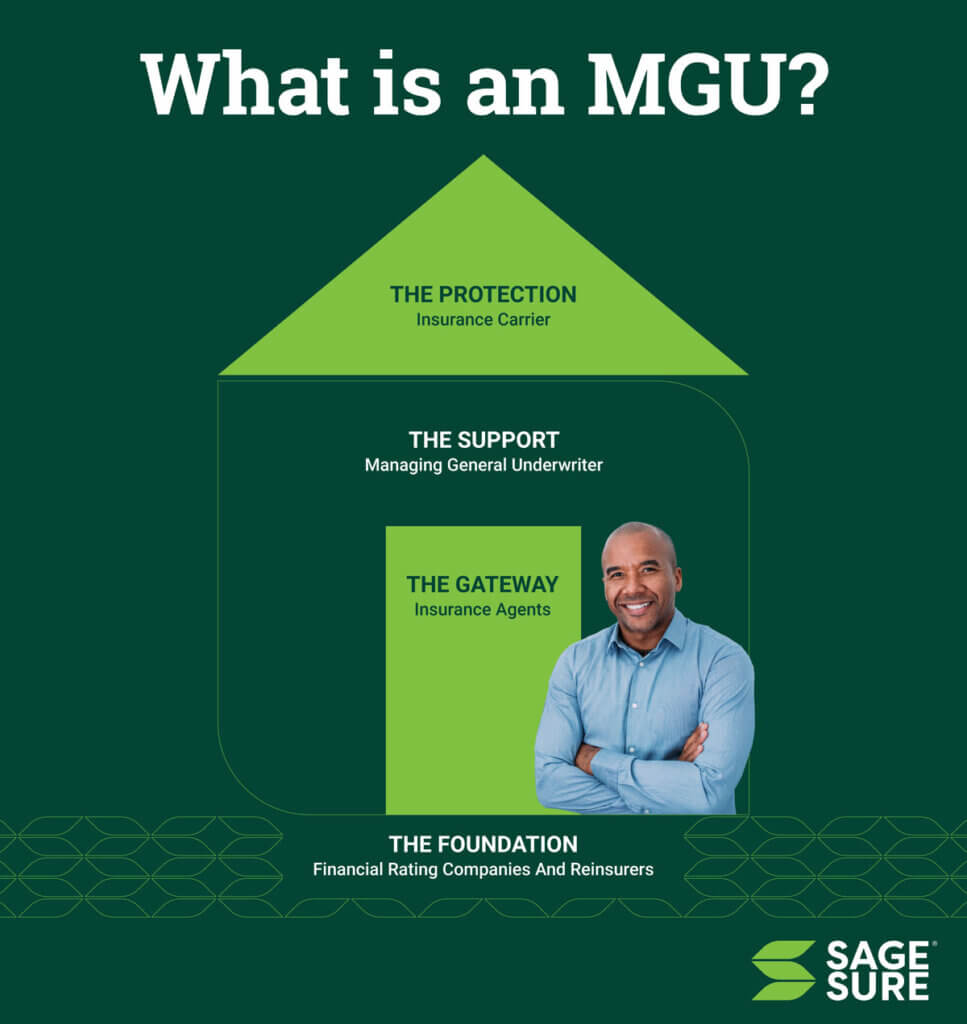

How MGUs Fit into the Modern Insurance Landscape

MGUs are part of the modern insurance landscape, often interfacing with insurance agents, carriers, and reinsurers to power the protection policyholders enjoy.

To better understand how MGUs fit into the insurance value chain, here’s a breakdown of how it all comes together.

A managing general underwriter, or MGU as it’s often referred to, is an insurance intermediary. With underwriting authority from an insurance carrier, MGUs serve as an extension of the carrier’s capacity and specialize in making data-based decisions that drive strategy and efficiency for the carrier. This allows an MGU to focus on creating specialized products, like SageSure’s products for catastrophe-exposed property. Like a carrier, MGUs can bind, underwrite and price policies. They are often also responsible for marketing and sales and distribution of the products and claims, but they cannot do any of these things without the backing of the insurance carrier.

An insurance carrier is a company that offers insurance. An insurance carrier might create and sell their products directly, or work with an MGU to create specialized products for their insureds. Carriers are the company providing the coverage and are responsible for paying claims.

When you’re looking to purchase a home insurance policy, you usually work closely with an insurance agent to understand the risks and the coverages available. Insurance agents can be employees of an insurance carrier, selling only one insurance company’s product, or they can work independently and sell products from a variety of insurance carriers.

Financial rating companies indicate an insurance company’s ability to pay claims. Using various factors, these companies measure the long-term strength and stability of an insurance carrier. Looking at things like an insurance company’s performance, financials and capital, these companies determine the likelihood that the insurance company can make good on their promise to pay a claim and then provide a rating to indicate financial stability.

Reinsurance is insurance for insurance companies. Reinsurance allows insurers to transfer part of their risk to other insurers through an agreement to decrease the chance of paying substantial losses resulting from large or catastrophic events.

It takes each of these entities working together to provide the peace of mind that a homeowners insurance policy offers.