Does my homeowners insurance cover a flood?

How to protect your home from water damage

October 25, 2022 — Disaster insights | Homeowner insights | Insurance insights

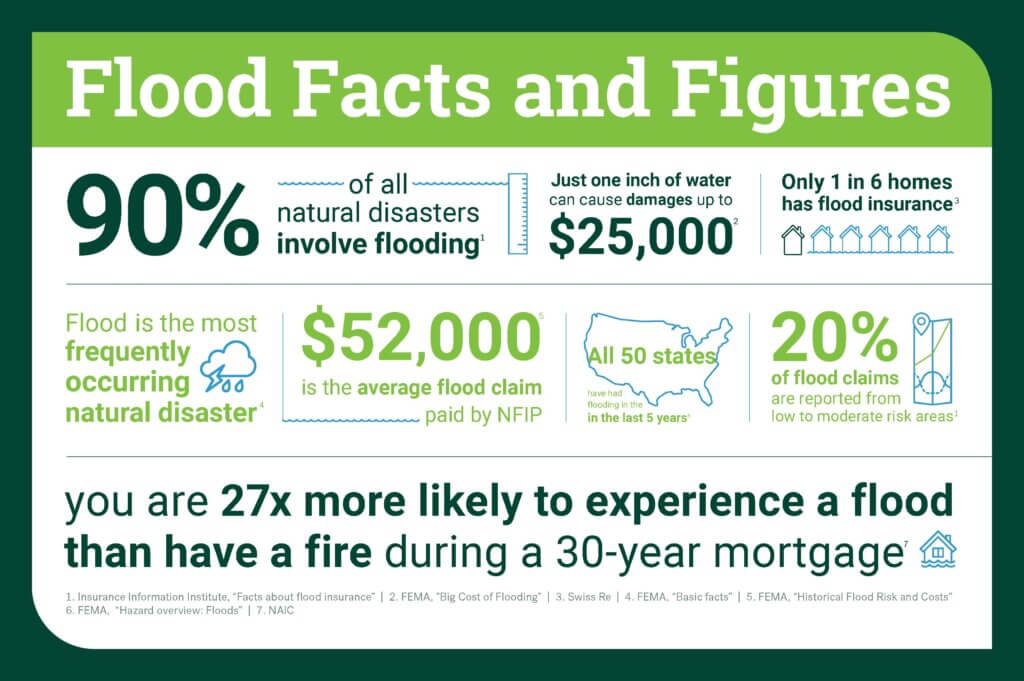

If you think a flood is something that only happens near oceans, lakes and rivers – think again. Ninety percent of all natural disasters involve flooding. Every U.S. state has experienced flooding in the last five years, and 20% of flood claims come from low to moderate risk areas.1

Circumstances are unpredictable. With these statistics, your home is at risk for experiencing a flood. In fact, throughout a 30-year mortgage, you are 27 times more likely to experience a flood than a fire.2

What you may be more surprised to learn is that the average homeowners insurance policy provides coverage for a fire – but not a flood. Insurance for your home provides protection for risks outlined in your policy documents but often perils, like earthquakes, pest infestations and flooding, are excluded and require separate policies. Being caught without flood insurance can be costly and devastating.

Flooding is also a complicated risk. What constitutes a flood and what is covered in the event of a flood is not straightforward. Here are some of the common questions about flood risk and flood insurance coverage.

What type of water damage is considered a flood?

According to the Federal Emergency Management Agency’s (FEMA) Standard Flood Insurance Policy for dwellings, a “flood” is when two or more acres of regularly dry land or two or more residential properties are inundated with water. What is considered a “flood” can differ in other flood insurance policies.

What can cause a flood?

Water can enter and damage your home in a variety of ways. What typically qualifies as a flood is caused by hurricanes, broken levees, clogged exterior drains, excessive rainfall accumulation and mudflow. In addition, changes to the land caused by wildfires, erosion and building development can affect water runoff and increase the possibility of flooding in urban and rural areas. Land changes for a new development have the potential to create flooding miles away.

What if my home is damaged by water but it isn’t a flood by definition?

Sometimes water damage occurs in your home that is not caused by flooding. When this happens, the damage might be covered without a separate flood policy. One way to understand whether water damage to your home is covered by a typical homeowners policy is to assess whether or not the water came in contact with the ground outside the walls of your home before entering your property. If the answer is no, your standard policy may cover your loss. A situation where this might happen would be water damage from burst pipes.

Is damage from flood water the same as water backup coverage?

Water can enter your home in other ways that don’t constitute a flood by definition but still may not be covered in your standard policy. Water from sewage backup and sump pump failure are not standard in homeowners coverages. In these cases, you would need a separate policy or add-on to your existing policy by an endorsement.

How do I protect my home and belongings from water damage?

Having the right insurance policy is the best safeguard against damage to your home. To ensure your home is covered for any water damage, you would need three different types of coverages.

- Your standard homeowners policy to protect against water damage from the inside – think plumbing issues.

- Water backup coverage is an endorsement added to a standard policy. This would cover your home and belongings when damage occurs from a broken sump pump, drain, or sewer overflow or backup.

- A separate flood policy protects your home when water enters as a result of storms, broken levees and excessive rain.

Remember, these are generalities. The only way to know you’re protected is to work with an agent to understand your policy and make sure you have the right coverages in place.

Do I need flood insurance?

Some mortgage companies require flood insurance if you’re in a high-risk flood area. Other lenders require it based on their specific risk tolerance. FEMA is the government agency that determines risk. You can learn more about flood mapping and your risk here. If you’re in a high-risk zone and have previously received disaster assistance grants or low-interest loans, you have to maintain flood insurance to qualify for future disaster assistance. It’s important to note that flooding can occur anywhere, and 20% of flood claims come from low to moderate risk areas. Flood insurance can also take up to 30 days to become active after you purchase the policy, so don’t wait for the rainy season to buy a policy.

What does flood insurance cover?

Properties with flood insurance typically are covered for losses related to the structure of the home, foundation, electrical and plumbing systems, HVAC systems, appliances, carpeting and personal belongings, including clothing, furniture and electronics. Water damage adds up. Just 1 inch of water damage can cause $25,000 in losses.3 However, flood insurance does have exclusions.

What is not covered with flood insurance?

Some policies like FEMA’s Standard Flood Insurance Policy for dwellings won’t cover expenses if you need to temporarily relocate because your home is uninhabitable from a flood. Be sure to check your coverages. Private providers of flood insurance sometimes provide coverage for temporary relocation costs. Basements and crawlspaces and personal belongings in those spaces are not covered by flood insurance. If you have a home gym in the basement or are storing Christmas decorations there, these items are not protected. Flood insurance also does not cover currency, precious metals and valuable paperwork, such as stocks. Cars and other self-propelled vehicles are also not covered; also excluded are exterior property like decks, fences, patios, landscaping and pools and hot tubs.

Should I buy private flood insurance or coverage through the federally backed NFIP (National Flood Insurance Program)?

Private insurance isn’t available in all areas. However, if it is something you can purchase in your state, it may be worth considering. NFIP coverage only covers losses up to $250,000. In some areas, this amount would not be enough to rebuild your home. Additionally, NFIP does not provide loss of use coverage if you need to temporarily relocate because of the damages. Private flood coverage often covers such expenses. Sometimes, private flood insurance will have a lower premium than NFIP, so know your options. You may be able to receive more coverage for a lower premium.

Flooding and protecting your home from water damage are complicated issues to understand. Bottom line, flooding is more common than you might think, and water damage is expensive, no matter the source. Make sure your home is protected. Work with an insurance professional to get the right coverages for your unique needs.

- Federal Emergency Management Agency, “Basic Facts about the National Flood Insurance Program,” 9-19-2016.

- https://content.naic.org/sites/default/files/inline-files/cmte_c_trans_read_wg_related_flood_insurance_basics_v4.pdf

- https://www.floodsmart.gov/flood-insurance-cost/calculator