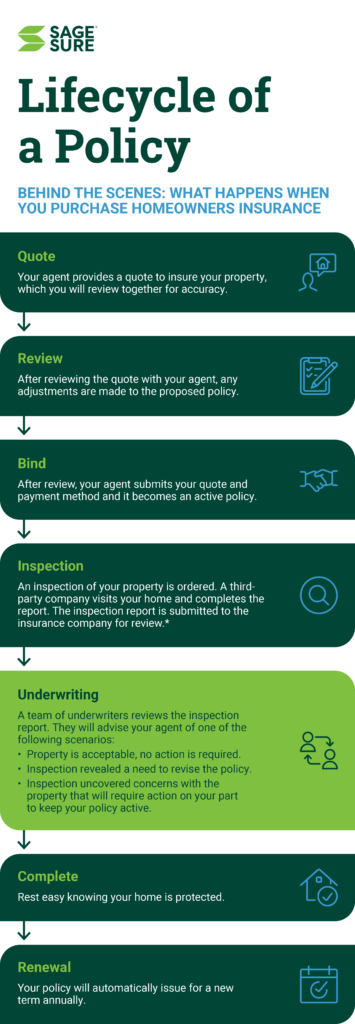

Behind the scenes: what happens when you purchase a policy

March 24, 2021 — Business insights | Insurance insights

You researched the area, found the perfect layout and property, and made an offer the seller couldn’t refuse. You are about to be the proud owner of a new home. But before your purchase is complete, you need to select a homeowners insurance policy. Whether this is your first home or your forever home, your home is your greatest asset, and you want to know it’s protected.

Purchasing an insurance policy for your home is a little less exhilarating than the hunt for the perfect house. However, understanding the steps that take a quote to an actual policy and then into renewal, is one way to makes the process simple to understand and smooth to execute. Here’s how the process works.

View or download the graphic as a PDF.

Select an agent

The first step to securing a homeowners insurance policy is to select an agent. If you’ve never purchased a policy before, asking friends and family for a recommendation on an agent they’ve worked with within the past can be the first step. After that, you’ll want to make sure the agent is a good fit for you and your needs.

Receive a quote

Your agent will collect information about the property to create a quote for insurance for your new home. Things like the home’s age, square footage, number of occupants, construction type, roof age and location factors, like distance to the coast, are all considerations your agent will need to know when generating a quote for a policy. Then you and your agent will need to discuss the types of coverages you want and need and the premiums and deductibles for those products.

Make necessary adjustments

Your agent will create a quote with all the information collected and discussed, and then it’s up to you to review the policy and determine if everything is as you discussed. If there are any necessary changes or errors, this is time to make corrections and get it right. The more accurate information is at this step, the smoother the inspection process will go, and the fewer surprises there will be to rate changes later in the process.

Bind the policy

When everything is as it should be your agent will bind the policy. With this step, the quote becomes an active policy. At this point, coverage is provided even though the policy has not yet been finalized. A series of steps are still required to complete the process.

Complete the inspection

Once the policy is bound, most insurance companies order an inspection by a third-party company. During this step, an inspector will visit your home, assess several conditions and factors of the home and surrounding property, and complete a report. To get an idea of the time it will take to move through the inspection process consult your local agent. They are the best source of information on inspection process timeframes as they can vary by state.

Wait for review by underwriting

Once the insurance company receives the inspection report, a team of underwriters reviews the inspection and conducts a thorough review of the policy and risks they are assuming the responsibility for insuring. In most cases, the property is acceptable as is and no further action is required.

When the condition of the property reported in the inspection is different from what was used to draft the quote, a change to the policy is warranted. For instance, if you have more livable square footage than what you previously reported, your policy might need to change to provide more accurate coverage.

Occasionally an inspection report will uncover a condition that needs correcting, like a pool without a fence. Policyholders are usually allotted time to resolve the condition before a cancelation notice is issued.

In a small number of situations, the inspection reveals something that makes the property ineligible for coverage. For instance, if the property is being used for a business. When this happens, the policy is rescinded, and coverage is immediately revoked. A cancelation notice is sent to the insured.

The underwriting review process can seem cumbersome, and sometimes just when you think you might be finished with the process you receive a notice to correct something. Try not to become frustrated. Companies that take this step seriously are the ones who consistently deliver on their promises.

Rest easy

When you get to this point in the process, you can relax knowing that your policy is effective and your property – your piece of the American Dream – is protected.

Renew your coverage

Each year you’ll need to renew your insurance policy (some companies automatically renew your policy). Use this time to take inventory of your assets and possessions. You may determine that you need to schedule a rider for a valuable piece of jewelry. Changes to your policy might also be necessary as a result of lifestyle changes or changes to your home, like a kitchen remodel or addition. These would require additional coverages.

When it’s time to renew, you might also notice that your rates have increased. Don’t be surprised by this. The value of your home has likely gone up and if you experienced a loss on your property, it would cost more to restore you and your family. Remember, that’s why you purchase insurance, to have the assurance that your home and belongings – the things you work hard each day to build and maintain – will be taken care of.